Our Lenders

Fixed Rate Home Loans Increase for 3 & 5 Year Terms

|

For the third consecutive month the RBA has left the cash rate on hold. We are however seeing an upward trend within the 3 to 5 year fixed rates. It would appear that the Banks appetite for discounting in this product segment is over. The big four banks have all recently increased their fixed rate offerings. Remember, fixed rates are generally more expensive than variable rates. After all, you're paying for peace of mind. When considering a fixed rate:

Aren't sure whether to fix or not?

If you aren't sure whether to fix or not, as a general rule you do have the option of splitting the loan between fixed and variable – so you can enjoy the flexibility of both worlds.

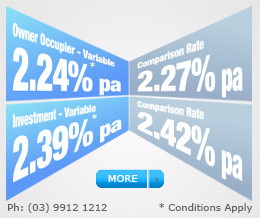

And there are some great variable rates still on offer if you know where to look…

As always, please feel free to call us at any time if you wish to review your current finances Adrian Rogers - Director / MFAA Credit Adviser Peter Cleary - MFAA Credit Adviser Until next time... Kind Regards, |