Our Lenders

Interest Rates - The Year In Review

|

At its last board meeting held recently the RBA again chose to leave the official cash rate at 2.5%, marking the 15th consecutive monthly meeting in which the Bank has chosen to remain on the sidelines.

The Year Ahead – Lower Interest Rates?

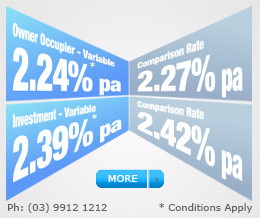

Could the lower price of oil together with a continued downturn in commodities lead to a reduction in interest rates. With the growth in prices slowing and many countries in Asia and Europe concerned about deflation there could be delays in interest rate rises or even cuts in some countries. A growing number of analysts are suggesting that there could be a cut in interest rates if inflation continues to be sluggish. Assuming any rate cuts are passed on to consumers that could mean good news on home loan repayments. We are continuing to see evidence of lenders’ competing for market share by offering further reductions in both fixed and variable product offerings.

As always please feel free to call us at any time if you wish to review your existing loan facilities or if we can be of any assistance sourcing new finance for you. Adrian Rogers - Director / MFAA Credit Adviser Peter Cleary - MFAA Credit Adviser Until next time... Kind Regards, |