Our Lenders

RBA Pulls Rate Trigger

|

At its first board meeting of the year in February, the RBA chose to cut the cash rate from its previous record low of 2.5% – where it was held for 15 consecutive months. Tim Lawless, head of research CoreLogic RP Data says the rate cut is likely to bring the cost of mortgage debt to its lowest level since July 1968, which the Reserve Bank should be mindful of in the context of the housing market. “Lower mortgage rates have the potential to add some fuel to what are already strong housing market conditions (dwelling values in Australia’s capital cities have already increased by 19.6% since interest rates started falling back in November 2011),” he said. “However, the stimulus from lower rates may not be as influential on housing market conditions as what we have seen in the past.”

Considering Refinance or Renovating

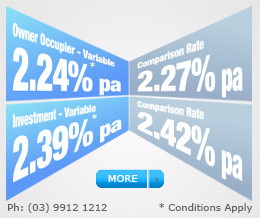

Given the prevailing low interest rates now is a good time to consider reviewing your existing Lenders interest rates. If you’re considering renovating, whether of a major nature or simply a cosmetic refurbishment, why not let us show you how this may be possible by using the equity you already have in your property!

As always please feel free to call us at any time if you wish to review your existing loan facilities or if we can be of any assistance sourcing new finance for you. Adrian Rogers - Director / MFAA Credit Adviser Peter Cleary - MFAA Credit Adviser Until next time... Kind Regards, |