Our Lenders

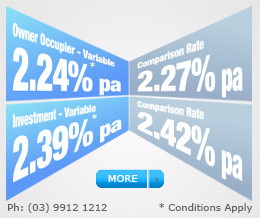

Investment Loans

Equity in your existing home can be used for investing in investment property, shares and collectibles. A separate interest only loan is generally recommended for an investment loan. This facilitates easy calculation of the tax deductible interest expense come tax return time. Investment loans often involve infrequent “one off” payments and are therefore more suited to a basic investment loan product (link to discussion on basic home loans).

Interest only investment loans

It is popular to contract investment loans as interest only (meaning your repayments are not paying down any loan principal). This reduces the required periodical loan repayments therefore allowing spare cash flow to be redirected to any other non tax deductible debt such as a home loan or personal credit card.

An interest only investment loan also allows you to redraw up to the original loan limit applied for at inception. This is because during the interest only period none of the principal has been required to be repaid. Interest only periods are subject to each lenders credit policies at time of application.

A one year fixed rate interest only investment loan can be useful for those looking to prepay next year’s interest expense this financial year. Depending on your circumstances this can enable a greater tax deduction this year and possibly no interest tax deduction in the next financial year.